Frequently asked questions On Property foreclosure into the CO

What exactly is a property foreclosure?

Foreclosures was an appropriate label regularly explain when a collector who keeps a home loan on your own home is requesting that it getting purchased in acquisition to meet or repay quantity that will be past due.

Widely known reason why a property foreclosure happens is actually for failure while making payments according to the regards to an excellent promissory notice. As a result, you (new resident) reduce the liberties towards the property that you own. A property foreclosure can also undoubtedly affect your ability in order to qualify for credit subsequently.

Within the Colorado, the most famous form of foreclosures is with the public Trustee. Anyone Trustee is actually an appointed certified whoever business has performing property foreclosure conversion process. Less frequent into the Colorado try an official property foreclosure, which is most commonly used in items of relieving unpaid assessment liens due so you can homeowners contacts.

Really does the loan organization must hold back until I am about a specific amount of days before they may be able begin property foreclosure?

In case the home loan are at the mercy of the real House Payment Procedures Operate, otherwise RESPA, then it dont begin a property foreclosure until an interest rate membership is more than 120 months delinquent. Very mortgage companies are subject to RESPA, although if not (the loan are myself funded), then your bank do not have to go to like several months.

Exactly what do i need to perform basically fall behind on my home loan money?

If you cannot help make your home loan repayments, step one in avoiding foreclosures is to try to chat to the home loan company. You’ll be able to request for you personally to get caught up in your unpaid repayments or for shorter payments. Of numerous lenders are prepared to enter some type of installment arrangement if you dropped about on your payments because of an enthusiastic unanticipated crisis or adversity.

It is crucial that that you do not overlook the letters you are receiving from your own financial. While having trouble to make costs because of dropping their work, quickly call or generate your own lender(s). Very loan providers have a loss of profits Mitigation Service one to works together with consumers that happen to be behind on the money.

You’ll be able to wish to contact good HUD-acknowledged homes counseling providers to have guidelines from inside the wanting to correspond with your lender. If you would like get a hold of a property guidance team, you might name the fresh Tx Property foreclosure Hotline during the step one-877-601-Hope (4673).

HUD-accepted guidance teams cannot ask you for due to their characteristics and are trained to assist borrowers go into working out to the lender. Avoid businesses that claim to help people who have financing adjustment to own a charge, since many ones are not managed immediately, in addition they may end right up doing your more harm than simply a beneficial.

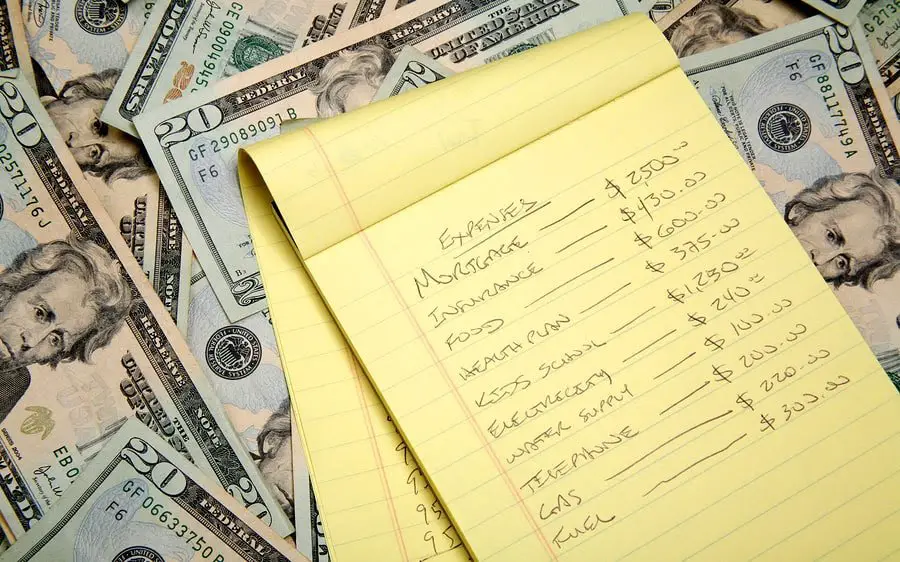

When you get hold of your financial, you ought to identify your position and stay prepared to promote him or her which have monetary advice, eg monthly earnings and you will expenditures and an explanation of your own situations one to triggered you to fall behind on your own money. Instead this post, they are certainly not in a position to help.

It is reasonably crucial on how best to remain in your own household for now because you could probably be eligible for additional advice. https://paydayloancolorado.net/valmont/ Although not, for people who forget your home you might not have the ability to qualify for a lot more direction.

Lastly, you will need to search any additional advice as you are able to be eligible for. For a list of other options and you will recommendations that may be open to consumers that have FHA-insured or Virtual assistant-insured mortgages, understand the matter lower than toward FHA/Va possibilities. Plus,if the loan is owed by the Federal national mortgage association or Freddie Mac computer, up coming there is certainly specific mortgage work-out available options for you around the guidelines. If you’re unable to qualify for a lot more guidelines, then you may must imagine selling your house for those who do not accept that the money you owe commonly increase.