Target Announces Strategic Plans to Drive More Than $15 Billion in Sales Growth by 2030

Suppose a business wants to know what their fixed costs should be, in order to hit a target profit of £250,000. Target profit is an integral part of the cost-volume-profit or the CVP analysis. The management can use the graphical method to calculate the break-even sales points as well as target profits for each product. The worst situation is when excessively optimistic target profits are continually released to the investment community, which eventually loses faith in the ability of management to meet its own projections. In this next scenario, a 10% increase in COGS reduces the operating profit and, subsequently, the operating margin. This may indicate increased costs, which could impact profitability and efficiency.

Unit Converter

At this point, the company will earn sufficient revenue to cover all the fixed costs. For instance, a business can set a dollar amount to achieve through increased sales. A common approach to achieving this desired profit is through the budgeting process.

- Minnesota Kayak Company needs to sell 28 kayaks in our example to break how to write a winning invoice letter in 8 easy steps even.

- If not, then the formula can be used to change any of the three parameters fixed costs, selling price, or product cost in order to reduce the number of units to an appropriate level.

- However, in many cases, there are several similar products manufactured in the same facility.

- If the profit is set to zero, the company can achieve the break-even point with the help of this equation.

- This is achievable because once a company determines the break-even point which covers all the costs (variable and fixed), the surplus over the break-even amount becomes pure profits.

- The business already knows their selling price is £150 per unit, their variable costs are £70 per unit and they expect to sell 5,000 units over the year.

- This tool simplifies the target profit calculation, making it accessible to business owners, financial analysts, and students interested in understanding the financial dynamics of sales and profit goals.

It helps businesses set realistic sales goals, budget effectively, and make informed pricing decisions. The price of your good or service, less any production or manufacturing expenses, is the contribution margin. The business already knows their selling price is £500 per unit, their fixed costs are £2.5m per year and they expect to sell 10,000 units over the year. Achieving profit requires controlling costs and achieving budgeted sales through this method. Best Tech retains 34.2 cents in operating profit for every $1 in revenue it generates, meaning it’s more efficient than its competitors at converting sales into profits after covering operating expenses. But remember that these figures can change over time due to factors like fluctuations in revenue and operating expenses.

BUSINESS MANAGEMENT:

A variation on the use of the break even formula can be used to determine the revenue needed to achieve a profit target level. Since budgets come with inevitable variances, an alternative method is desired. An alternative method is to follow the cost-volume-profit or the CVP approach.

BUSINESS ENVIRONMENT:

He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. Draw the lines to represent the profits of products P2 and P3 ranked respectively according to the C/S ranking. However, many businesses fail to achieve it through this approach as they cannot control budgets. The number should not be rounded down because when 64 products are sold, then the profit earned will be slightly less than the expected Target Profit of USD$5,600. It is possible to calculate Target Profit using the basic yet the most important business formula, the formula for profit where Profit equals to Sales Revenue – Total Costs (TC). It’s not just about picking a number randomly, but instead finding that balance between a price that will attract customers, while also ensuring that price keeps the business profitable.

Advantages of Using Target Profit Approach

An alternative method using the weighted average cost to sales (C/S) ratio can be used to determine the target profit as well. If the company ABC had set a target point, the crossing point at the x-axis will represent the required sales to achieve that target profit. This goal is often set based on a number of different things, such as market trends, competition, and the company’s overall goals.

Now let’s assume a business want to determine what price to sell their consultancy services at to achieve a target profit of £50,000 for the year. There are several formulas that can be used to calculate target profit, depending on the information available and the specific context of the business. Mastering EBITDA alongside gross profit is about unlocking a company’s true potential.

Cost-Volume-Profit Analysis

But keep in mind that to get a complete picture of your business’s financial health, operating margin should be used alongside other financial metrics. Understanding the target profit and required sales units helps businesses in strategic planning, pricing strategies, and evaluating the feasibility of profit goals. It’s particularly useful in break-even analysis, forecasting, and setting performance benchmarks.

For investors prioritising a consistent income stream from dividends, net profit becomes a critical indicator. It demonstrates the company’s capacity to generate sufficient earnings to support consistent dividend distributions. Companies with a history of stable or bonds payable increasing net profits are likely to sustain or enhance their dividend payments, making net profit a key metric for income-focused investors.”

If the target profit suggests a need for increased production, the company can invest in additional machinery or resources to meet the demand. Having a target profit in mind becomes instrumental in this decision as the business is able to evaluate the potential costs of the new machinery, including purchase, installation, and maintenance. Target profit is the desired level of profit a business aims to achieve within a specific period.

It means when the business generates revenue beyond the break-even point, it starts earning profits. The management can set a specific amount as target profit above that break-even point. Understanding how to calculate operating margin can help business owners measure their company’s profitability and efficiency. Comparing your business’s operating margin with similar companies in your industry can help you see how formula for a net profit margin you stack up against the competition.

What is a good operating margin for a company?

- Now let’s assume a business want to determine what price to sell their consultancy services at to achieve a target profit of £50,000 for the year.

- Choose an endpoint and targeted profit for your target profit estimation before you do anything else.

- Many trading platforms provide EBITDA and gross profit figures to help traders evaluate stock performance.

- Financial projections involve determining what level of profit you want from a business.

- Target profit and cost-volume-profit analysis combined can offer useful information to the management for decision-making in the long term.

- The graphical method of the profit-volume analysis assumes that the company must sell its most profitable product first.

The first step is to determine the profitability of each product and rank them accordingly. The graphical method of the profit-volume analysis assumes that the company must sell its most profitable product first. Aside from the determination of the break-even point, the CVP analysis can determine the level of sales required to generate a specific level of income. The target income could be expressed on a before-tax basis or after-tax basis. In all those cases, nonetheless, the CVP analysis can compute for the required sales volume. Target profit is the expected amount of profit that the managers of a business expect to achieve by the end of a designated accounting period.

The target profit method can be used in a single or multiple-product environment. However, it also offers some limitations in the form of variance in results, employee demotivation, and unrealistic approaches from the management. If the profit is set to zero, the company can achieve the break-even point with the help of this equation. Else, the desired profit amount is set to determine the output quantity or the production volume level.

Target profit is defined as the expected amount of profit that a business intends to achieve during a specified accounting period. In previous pages of this chapter, we have focused mainly on the break-even point. However, the core objective of every business is not just to break even, but to earn a decent amount of profit. Our mission is to provide useful online tools to evaluate investment and compare different saving strategies. Although calculator usage is pretty straightforward, you must understand all the fields correctly to prevent any misinterpretations of the results. This allows businesses to assess whether they are on track to meet their goals, or an early warning signal if strategic adjustments are needed.

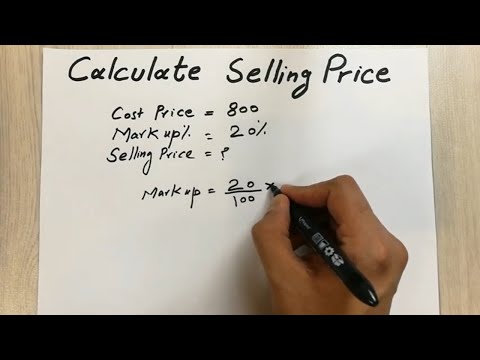

Businesses use the target profit formula to calculate how much money the company should generate over a predetermined period. According to Bernard M Cornell, businesses utilize this statistic to anticipate development potential, plan budgets, and maximize investments. The real profit your firm makes may be more or lower depending on actual sales, expenses, and other factors. Let’s say a business has annual fixed costs of £65,000, variable costs per unit of £10 and a selling price per unit of £30. For example, if the target profit level is 7,000, fixed costs 36,200, and the gross margin percentage is 60%, then the revenue needed to achieve the target profit is given as follows.

Finally, to get your desired profit, advisor Bernard M Cornell offers to determine your fixed cost expense. Your company must cover fixed costs regardless of sales or production levels. The rent or mortgage on your workspace, utilities, and office supplies how to calculate sales tax on gross income are typical instances of fixed costs. You should factor these costs into your goal profit calculation because they have an effect on your overall profit potential. Consider to borrow cash online if you realize that the budget is not enough to cover your company’s expenses.